AVONDALE, Arizona – Estrella Mountain Community College (EMCC), a Maricopa Community College, continues its long-standing partnership with the Valley of the Sun United Way (VSUW) to be an official community site for the federal Volunteer Income Tax Assistance (VITA) program and Tax Counseling for the Elderly (TCE). For the fifth year, EMCC will be hosting free tax preparation services for those who qualify.

The free tax assistance program is available to taxpayers who made under $53,000 in 2014, the elderly, and those with disabilities or limited English speaking abilities.

The certified volunteers help prepare, process and electronically file basic tax returns for personal income, and can also inform taxpayers about special tax credits for which they may qualify, such as Earned Income Tax Credit, Child Tax Credit, and Credit for the Elderly or the Disabled.

EMCC’s Business Institute students and the other community volunteers are required to be certified to prepare taxes. They are trained through the EMCC accounting course, ACC 121, Income Tax Preparation, team taught by EMCC Business Institute adjunct faculty, Kortney Song and new Business Institute Faculty, Dr. Sylvia Ong, in the fall semester proceeding the tax season. Successful completers receive the two levels of certification to be eligible for the VITA program. The EMCC students will be volunteering their expertise and time as part of their internship requirement.

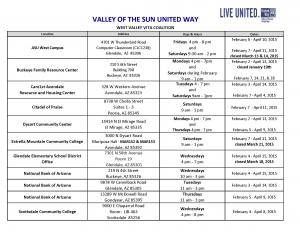

The EMCC VITA site is providing services every Saturday, February 7 through April 11, from 9:00 a.m. – 1:00 p.m., in Mariposa Hall rooms 152 and 153, on the EMCC campus located at 3000 North Dysart Road in Avondale, Arizona. No appointments are necessary. NOTE: All Maricopa Community Colleges will be closed March 19 – 21 for Spring Break, so there will be no VITA services at EMCC on Sat., March 21.

In order to prepare taxes accurately and efficiently, the following items will be required:

*Social Security cards, IRS ITIN card or ITIN letter for all household members

*Picture ID for taxpayer (and spouses)

*Birth dates for all persons listed on the tax return

*Proof of all income, including W-2 and 1099 forms

*Name, address, and tax ID# of childcare provider

*Amount of money paid to childcare provider last year

*Account and routing numbers for direct deposit

*Copy of last year's tax return, if available

*If filing jointly, both adults must be present to sign the return.

To assist self-tax preparers, the VITA site at EMCC offers an option for free federal and state e-filing for those earning $60,000 or less. It can be accessed directly at the MyFreeTaxes website www.myfreetaxes.com/emcc.

A toll-free MyFreeTaxes Helpline is also available during tax season at 1-855-My-Tx-Help (1-855-698-9435), from 7am-8pm, Monday-Saturday.